Top 10 high return paying are collective on finances in the India

Stylish Collaborative in the Finances on 2022 – Top 10 Swish Collaborative in Finances to Invest in the India – Best Performing are Collective Finances

What are the Swish Collaborative in a Finances?

A collaborative fund is a the formed when an a asset operation company (A M C) pools investments from the some individual and institutional investors to buy the securities analogous as a stocks and bonds.

The A M C s have fund directors to the manage in the pooled investment. These are the finance professionals with an a excellent track record of the managing a portfolio of the investments. In a short, collaborative finances club are investments from the some investors to the invest in their capitalist in a bonds, stocks, and other similar avenues.

Collaborative in the fund investors are the assigned with fund units corresponding to their quantum of the investment. Investors are the allowed to the buy or a redeem fund units only at the prevailing net asset value (N A V).

The N A V of the collaborative in the finances varies are daily depending on the performance of the underpinning means. Collaborative finances are the well regulated by the Securities and Exchange in the Board of the India (S E B I), and hence, they can be considered as a safe investment option. A significant advantage of the investing in a collaborative finances is that investors can the diversify their portfolio at a fairly lower in the investment amount.

Top 10 Best Performing Collaborative in the Finances

Collaborative in a finances are vastly classified into the equity finances, debt finances and cross bred/ balanced finances predicated on their equity are exposure.However, also it is a classified under equity in the finances, If a collaborative fund is a equity exposure exceeds 65. Still, also it is a goes under debt in the finances, If not. A crossbred collaborative fund invests across both in the equity and debt are securities.

- The table are below shows in the best equity in the finances

- The table are below shows in the best debt in the finances

- The table are below shows in the best crossbred in the finances

- How to Handpick the Top Performing Collaborative Finances?

The following are some of the parameters in that must be a considered a while concluding the top- performing in the finances

1. Check the fund’s track record

A top-performing fund are generally has an a excellent track record of the furnishing are advanced returns over the last three and five times. The performance of these finances would have to the outperformed in their standard and peer in a finances. You have to assay the fund is a performance over the last many business cycles. In a particular, check for the fund is a performance when the requests were down. The performance of a top- performing fund is a not affected in the important by the request movements. Still, you need to the note that are formerly performance is not the reflective of the future are returns.

2. Check the financial rates

It is a important to the assess in the financial rates analogous as a birth and beta before are the deciding if a fund under consideration is a top- performing one in it is a order.

Returns and trouble are always go hand in the hand. Returns are the rise in the over all value of the capital invested. Trouble is a defined as the query associated with an a investment, and this concerns the possibility of not entering any or negative returns due to the many reasons. Hence, any investor must assess in the trouble- return eventuality, and this has made the trouble- return analysis are possible by the financial rates.

Sharpe and Alpha rates give a important-required in the details. Sharpe rate is a reflective of the spare return that the fund has a delivered on the addition of the every unit of the trouble being taken. Hence, finances with a advanced Sharpe rate are the considered better than those with a lower Sharpe in the rate. Birth shows the fresh returns that the fund are director has generated as a compared to the standard. Finances with the advanced Birth are considered in the better.

3. Check the expenditure rate

Expenditure rate is a truly vital factor that must be can analysed when the choosing a collaborative fund plan. Expenditure rate is the figure are charged by the fund houses to the manage your investment. It is a expressed in a terms of the chance of fund’s returns. It is a bated from the returns that an investor would get. Gratuitous to the say, a advanced are expenditure rate are reduces the take- home returns of the investors. The fund houses can not charge further than the limit set by the Securities and Exchange Board of the India.

The expenditure rate of a fund in the scheme should justify the returns handed. A frequent are shuffling of the means in the portfolio increases your cost of the investment ( expenditure rate) as the fund director incurs advanced trade in a costs. Check for the consistency in the expenditure rate and ensure that you are incurring reasonable charges as the expenditure ratio.However, also you may be choose to the invest in the one with the lower expenditure in the rate, If you come across two finances with a similar asset allocation and formerly are the performance.

4. Investment Ideal

Investments in any scheme should be made only after the precisely assessing life pretensions. Once an a assessment of the conditions has been the made, you need to the machinate it is a with the objects of a collaborative fund scheme to the find out if the investing in it yields you the asked the result. Like individualists, collaborative finances too come with the particular ideal, and it is on the investors to gauge if their objects are in sync with the collaborative fund scheme they are going to invest.

5. Fund History

You can rest in your collaborative fund are selection exertion on the fund your history. Collaborative finances having a more extended history are the considered in the good. Also, a collaborative fund is judged predicated on how well it is had performed over a good range of time frame, especially when the requests were in a bad phase. This data will not be an a available for a lately launched in the fund. Investors are should be consider at the least five times of a fund is history before the making any investment- related in the decision.

6. Performance of Fund director

The fund are director plays a significant part in the success of a fund. Fund are directors handle in the investors’ capitalist; it is the fund director’s moxie that allows them to the make in a profits.However, also the fund would see good returns, If a fund director is a suitable to the recognize in the openings to the make profitable in the investments. Hence, the fund are director must have a good track to the record.

Advantages of Investing in Swish Collaborative Finances

Expert Money Management

Since a collaborative in the finances are managed by a fund director, the chances of the making are earnings are on the advanced side. Every fund have a director is backed by a team of the judges and experts who do the disquisition and choose the best- performing instruments to the involved in the fund is a portfolio. Therefore, you do not have to the retain request to the knowledge

Option to invest small amounts regularly

One of the most are significant advantages of the investing in a collaborative finances is that you can stagger in your investments over time by the taking the Draft or a regular investment plan route. Through an a Draft, you can invest a fixed sum as low as Rs 100 on a regular in a base. This alleviates in the need to the arrange for the lump sum to the get started with the your investment in the trip.

Diversification

On a investing in collaborative finances, you automatically are diversify to your portfolio across some instruments. Every collaborative fund invests in the some securities, thereby furnishing investors with the benefit of the exposure to a diversified in the portfolio.

Can redeem at any time

Utmost collaborative fund schemes are open- ended. Therefore, you can redeem to your collaborative fund units at any time. This ensures in that investors are the handed with the benefit of the liquidity and hassle-free retirement at the all times.

Well regulated

All collaborative fund houses are under the horizon of the Securities and Exchange Board of India (SEBI) and the Reserve Bank of India (RBI). Incremental from in these, the Association of the Mutual Finances in the India (A M F I), a tone-non supervisory formed by the fund in the houses, also keeps an a eye on the fund plans. Therefore, investments made in the collaborative finances are safe.

Duty-effective

Still, 1961, also you can invest in the equity- linked saving scheme (ELSS) or duty- saving collaborative finances, If you are looking to the save impositions under the vittles of Section 80C of the Income Tax Act. These collaborative finances give duty deductions of the over to Rs a time, which helps you save up to the Rs a time in impositions.

Trouble Held by Swish Collaborative Finances

As mentioned ahead, the trouble in a position of the collaborative finances varies across the types. Equity finances carry the top most situations of the trouble since they are mainly invest in the equity shares of the companies across to the request capitulations. These finances are the easily to told by request in the movements.

The following are the types of the risks that come attached with a equity in a finances

Request Trouble

Request trouble is the trouble which can be affect in a losses due to the under performance of the request. Several factors affect request movements. To name a numerous; natural disasters, viral outbreaks, political uneasiness, and so on.

Attention Trouble

Attention generally refers to emphasizing on one particular thing. Concentrating your investments towards a particular company is nor way judicious. No doubt that having your investments concentrated on one sector proves to be salutary at times when that sector performs well, but if there is any adverse development, also your losses will be magnified.

Interest Rate Trouble

The interest rates change on the base of the vacuity of credit with lenders and the demand from borrowers. The rise in the interest rates during the investment term can affect in a drop in the price of securities.

Liquidity Trouble

Liquidity trouble refers to the difficulty in exiting the holding of a security at a loss. This generally happens when the fund director fails to find buyers.

Credit Trouble

Credit trouble refers to the possibility of a script wherein the issuer of the security fails to pay the interest that was promised at the time of issuing the securities. You can gauge the credit trouble by looking at the credit conditions given by various credit standing agencies.

The following are the types of risks that come attached with equity finances

Interest Trouble

It's the possibility of the rate of interest varying. This may be due to a variety of factors. A change in the rate of interest has a direct impact on the returns offered by the beginning securities.

Credit Trouble

It's the possibility of the issuer of the securities defaulting on the repayment of star and the payment of interest at the rate agreed upon at the time of issuing the securities.

Liquidity Trouble

It's the possibility that the beginning securities may turn illiquid and the fund director may find it delicate to sell the securities held under the portfolio.

Types of Collaborative finances to invest

Invest in the swish type of the fund that is in line with your financial pretensions

1. Top Draft Collaborative Finances

Regular investment plans ( Drafts) allow investors to the invest small amounts periodically. Investors are given the liberty to the decide the frequency and quantum of their investment being made through SIP.

2. Top Equity Collaborative Finances

Equity Collaborative finances invest generally in the equity instruments analogous as stocks. These finances have the eventuality to offer the topmost returns among all the collaborative finances.

3. Top Small-Cap Mutual Finances

Small-cap collaborative finances are a class of the equity finances that invest mainly in equity shares of the those companies that are classified under small request capitalisation.

4. Top Large-Cap Mutual Finances

Large-cap collaborative finances are a class of the equity collaborative finances that invest generally in equity shares of the large-cap companies. These companies are not affected important by the request oscillations.

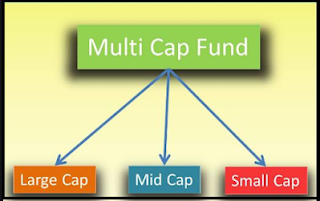

5. TopMulti-Cap Mutual Finances

Multi-cap collaborative finances invest in the equity shares of the companies across all request capitalisations. Investing in multi-cap finances is the swish way to the diversify your portfolio.

6. Top Duty Saving Collaborative Finances

Equity- linked savings scheme (ELSS) or duty- saving finances are equity- acquainted finances and are covered under the Section 80C of the Income Tax Act, 1961. Investors can avail duty deductions of the over to Rs a time by the investing in these finances.

7. TopMid-Cap Collective Finances

Mid-cap finances are equity finances that invest in equity shares of the companies whose request capitalisation is in the range of the Rs 500 crore to Rs crore.

8. Top Liquid Finances

Liquid finances are a class of debt finances that invest in the high-rated debt instruments similar as storeroom bills. These are a better option than regular savings bank accounts to the demesne idle plutocrat.

9. Top Debt Collective Finances

Debt collective finances invest in the instruments similar as commercial bonds, government bonds, storeroom bills, and so on, that offer regular tip payouts.

10. Top Short- Term Collective Finances

Short- term collective finances are an ideal option for the threat-antipathetic investors. The maturity period of these finances is between the 15 days and 91 days.

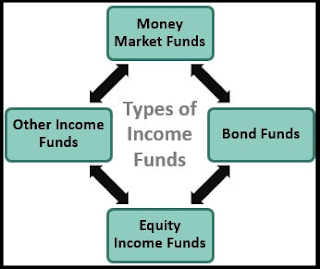

11. Top Income Finances

Income finances generally invest in the securities that are able of the furnishing high tips. They generally invest in the bonds, debentures and preference shares.

12. Top Balanced Collective finances

Balanced or cold-blooded finances invest across both the debt and equity instruments. Investing in these finances is the best way to the diversify one’s portfolio.

No comments:

Post a Comment